From Leased to Loved

annual lease buyout report

Key lease buyout loan statistics, trends, and insights for drivers, dealers, lenders, and the media

Lease End 2025 Buyout Report sourced from Jan 1 - Dec 31 2024 vehicle lease buyout transactions and 2025 YTD insights.

This report serves as a real-world look at how lease buyouts are shaping today's auto market. Statistics are based on Lease End's proprietary nationwide 2024 lease buyout data.

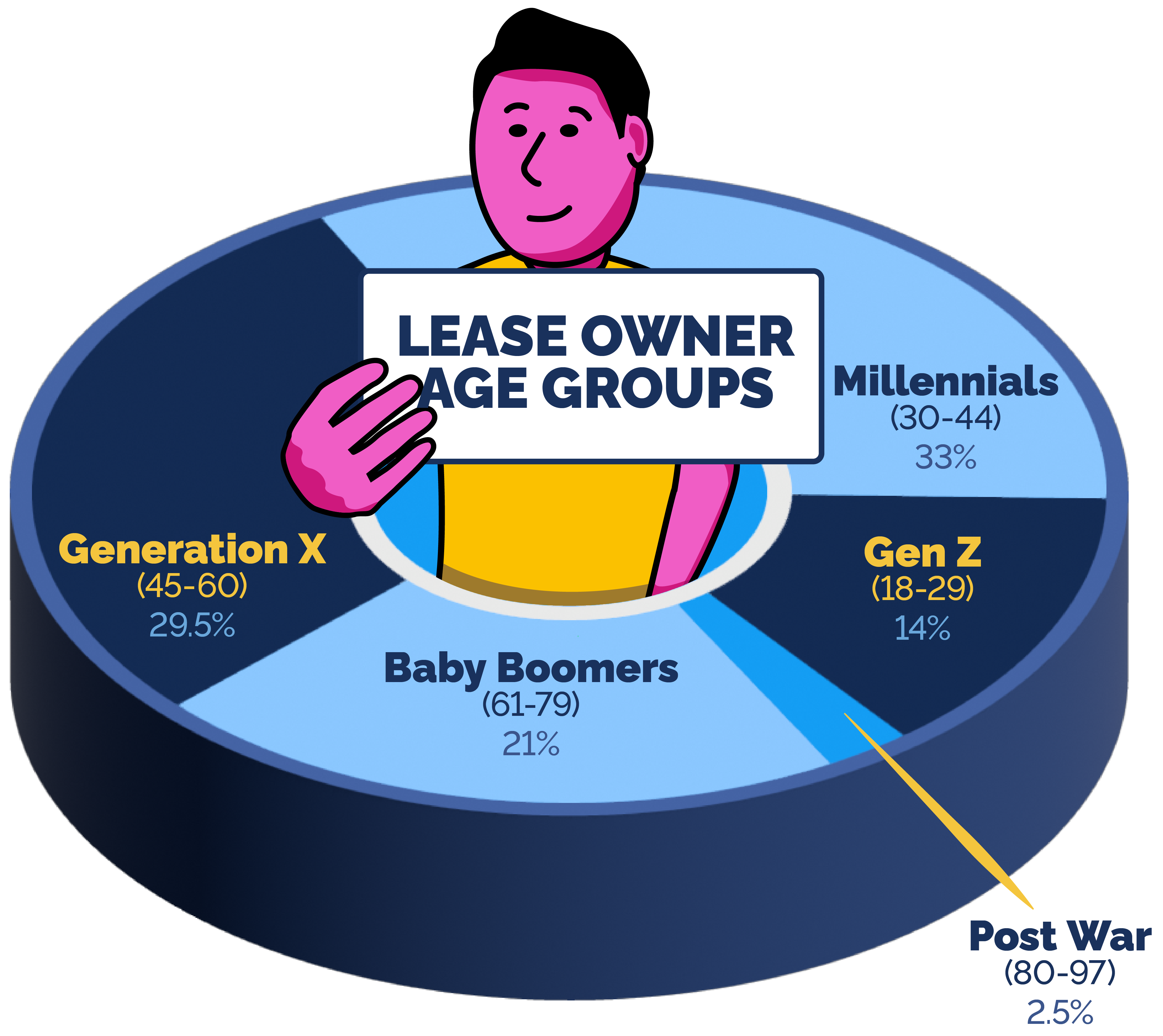

demographic data

Over half (53%) of lease buyouts came from drivers 45 and older, preferring to keep the vehicle they know and trust

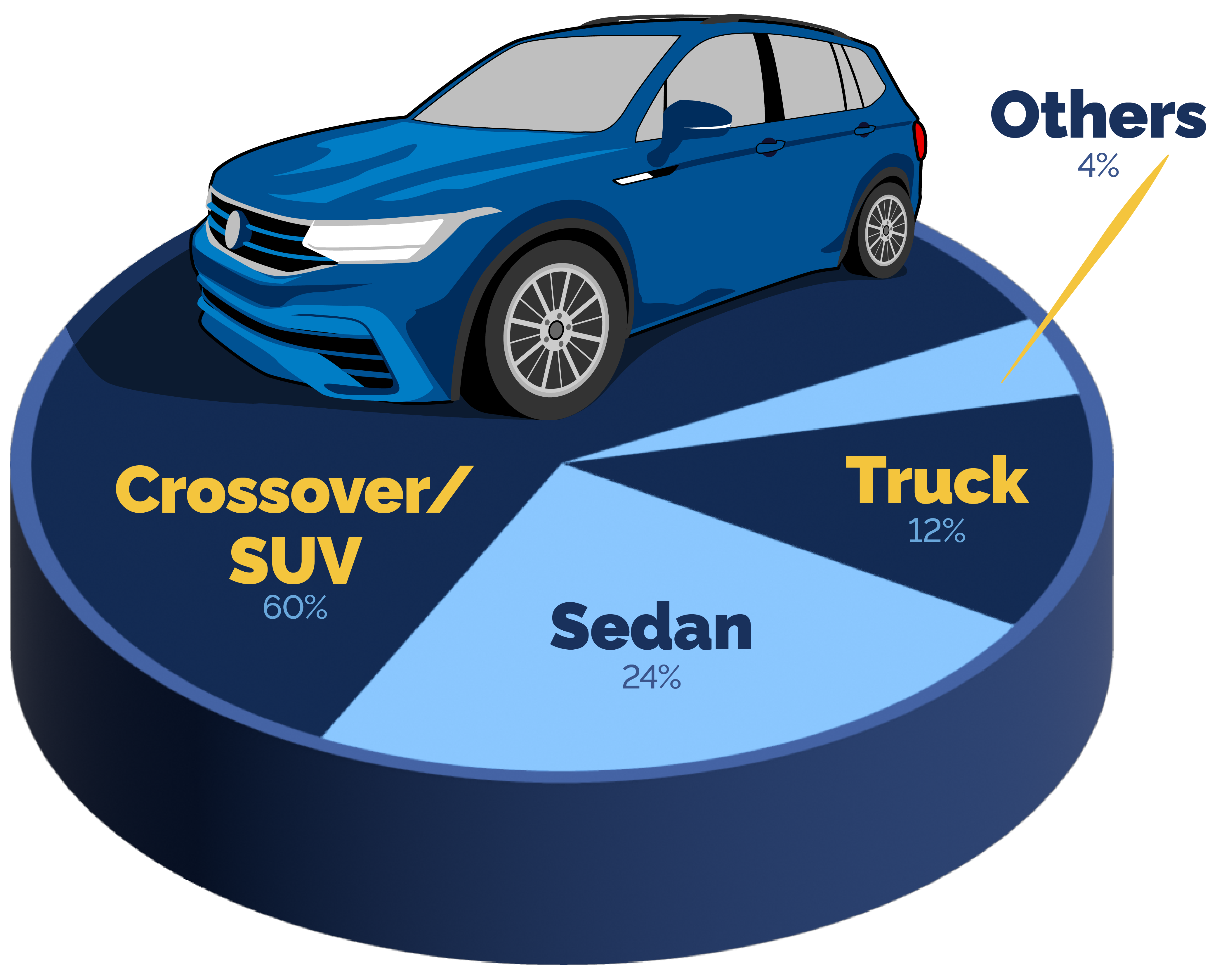

MOST POPULAR BRANDS & VEHICLE TYPES

SUVs and sedans were the most popular vehicle categories for lease buyouts, reflecting family and commuter needs.

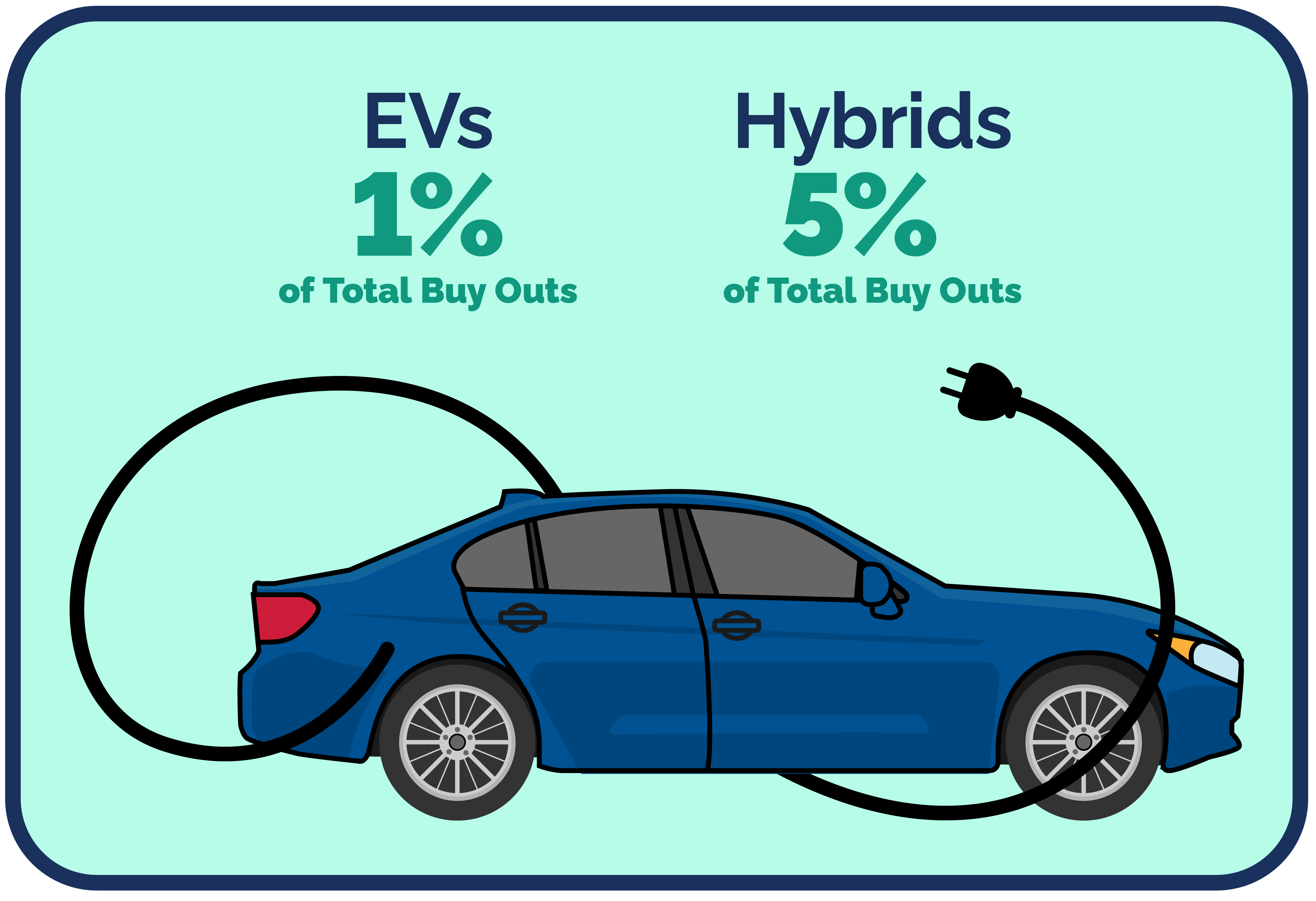

Despite continued EV talk, adoption is still very low for lease buyouts - EVs accounted for only 1% of all lease buyouts in 2024.

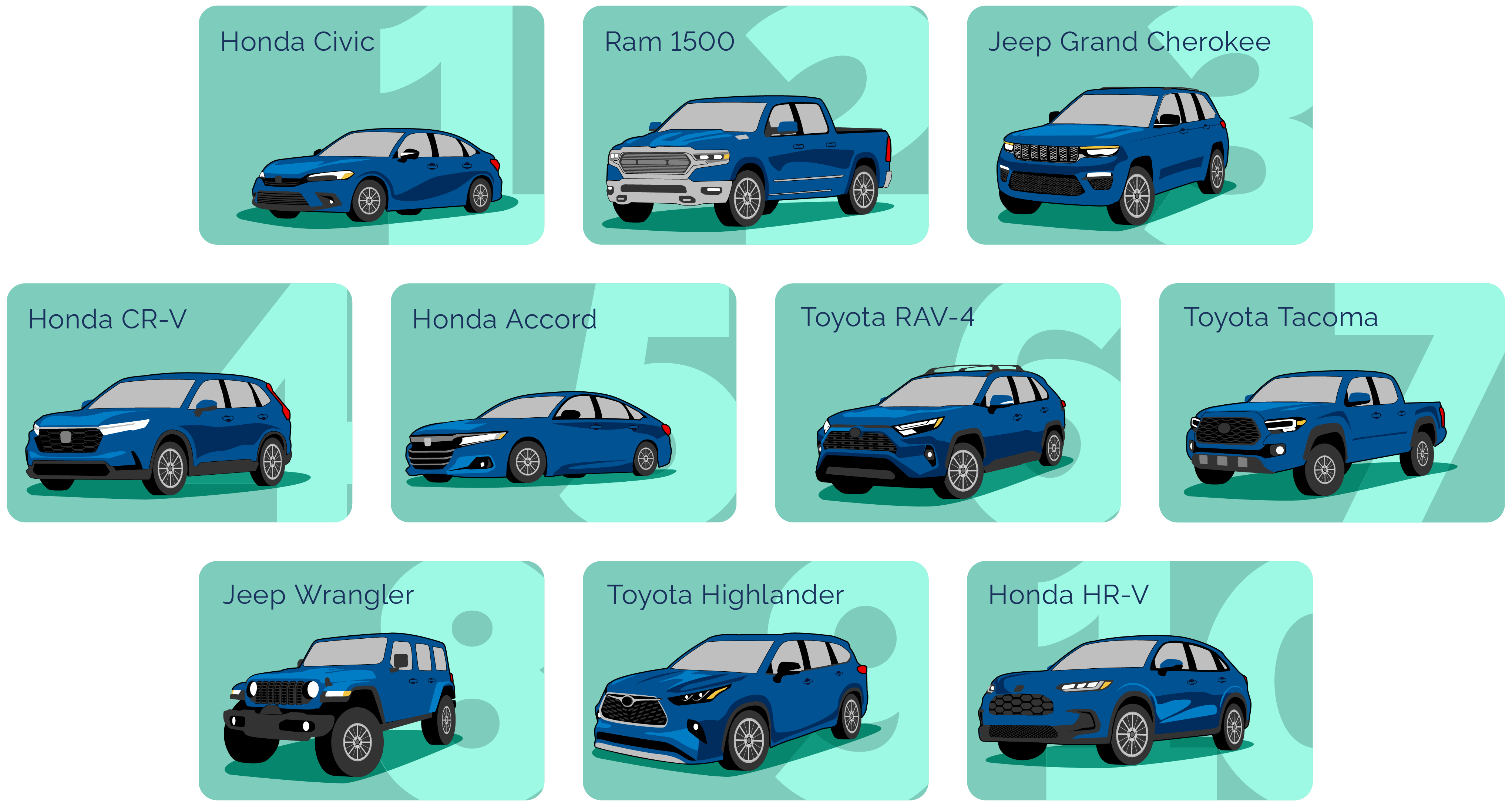

Honda and Toyota lead the top 10 lease buyouts for two reasons - people trust them, and they hold their value.

The top 8 most popular models for lease buyouts remained the same in 2024 as in 2023. New top- 10-ers in 2024 were the Toyota Highlander and the Honda HR-V, replacing the Toyota Corolla and Volkswagen Jetta in the top 10 list.

equity & loan trends

When a leased car's market value is higher than the lease payoff amount, there is lease equity for lease buyout candidates. Equity retained minimizes the financing amount needed.

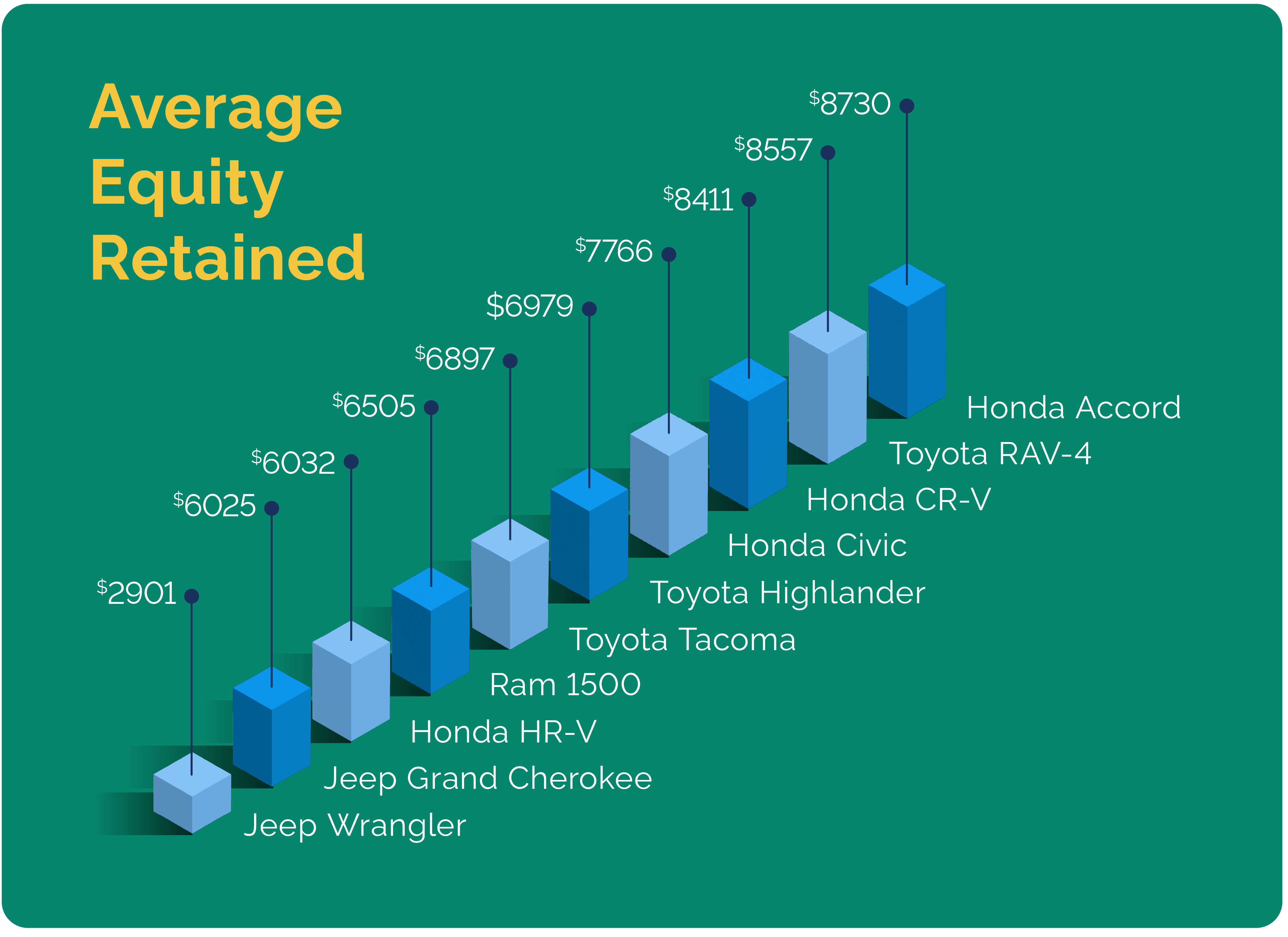

Equity for the top 10 most popular models in 2024 ranged from $2,901 to 8,730.

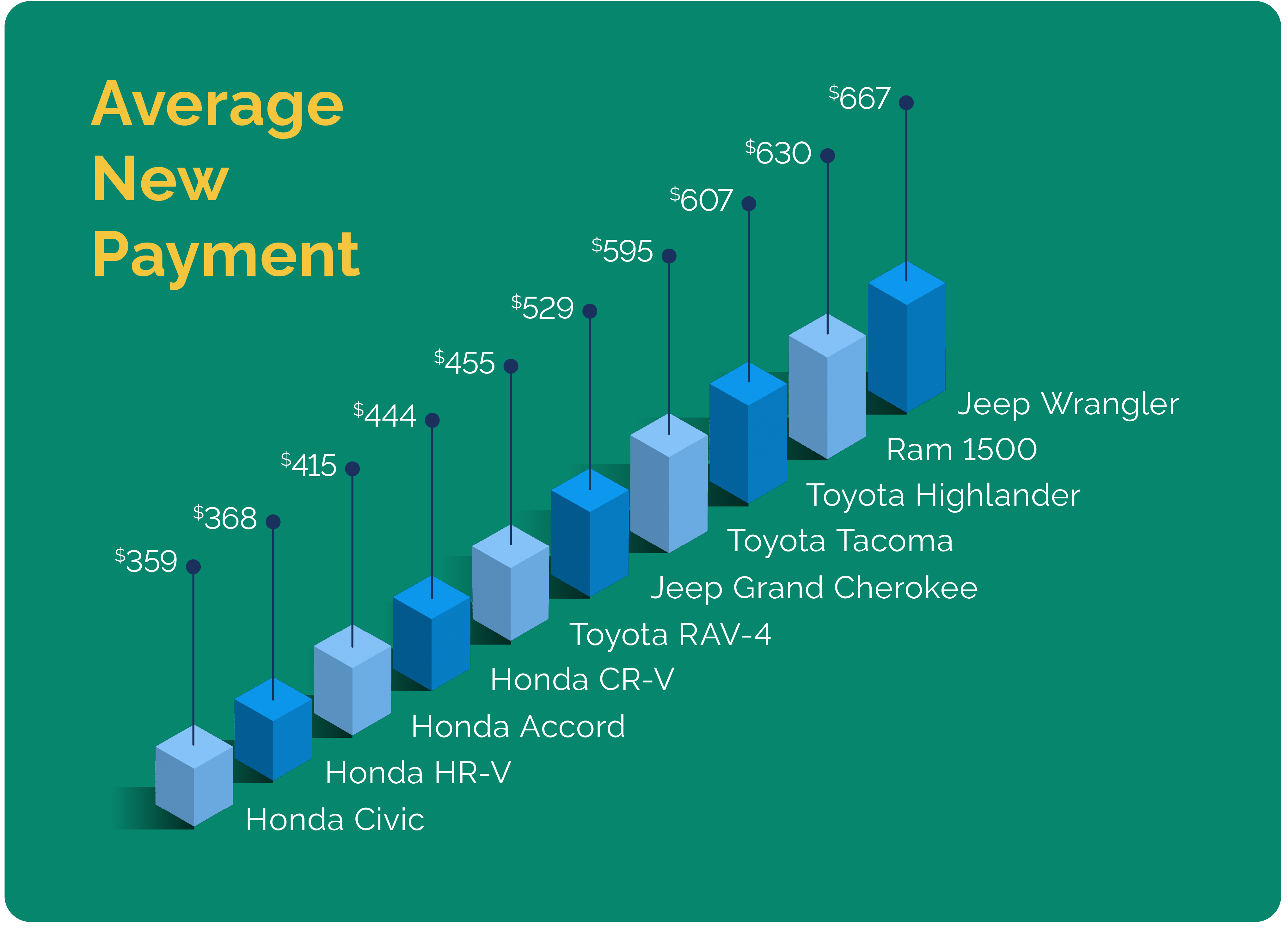

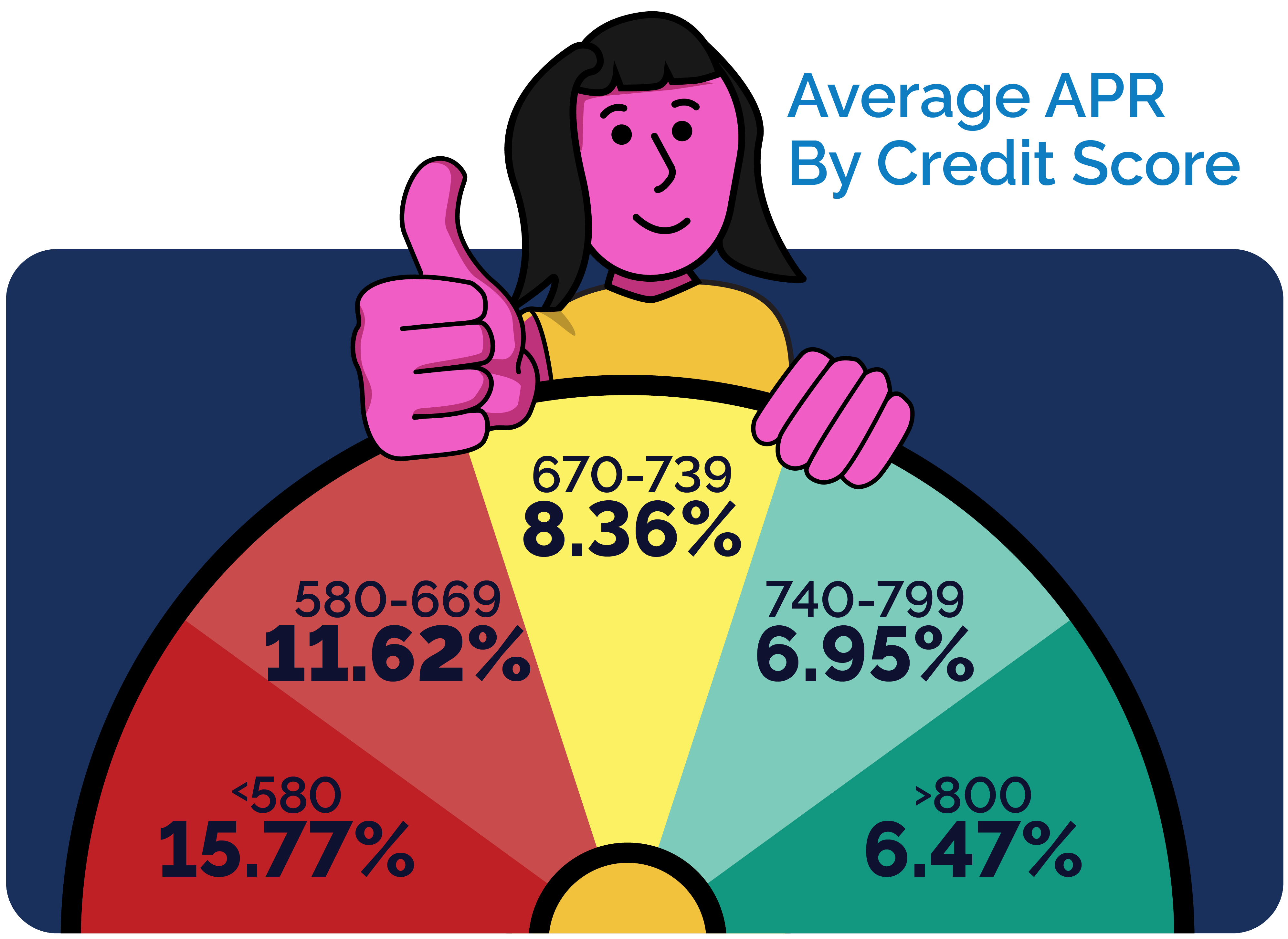

While monthly payment, term length, and rate vary from driver to driver, 2024 data show favorable loan rates and monthly payments for drivers with a higher credit score.

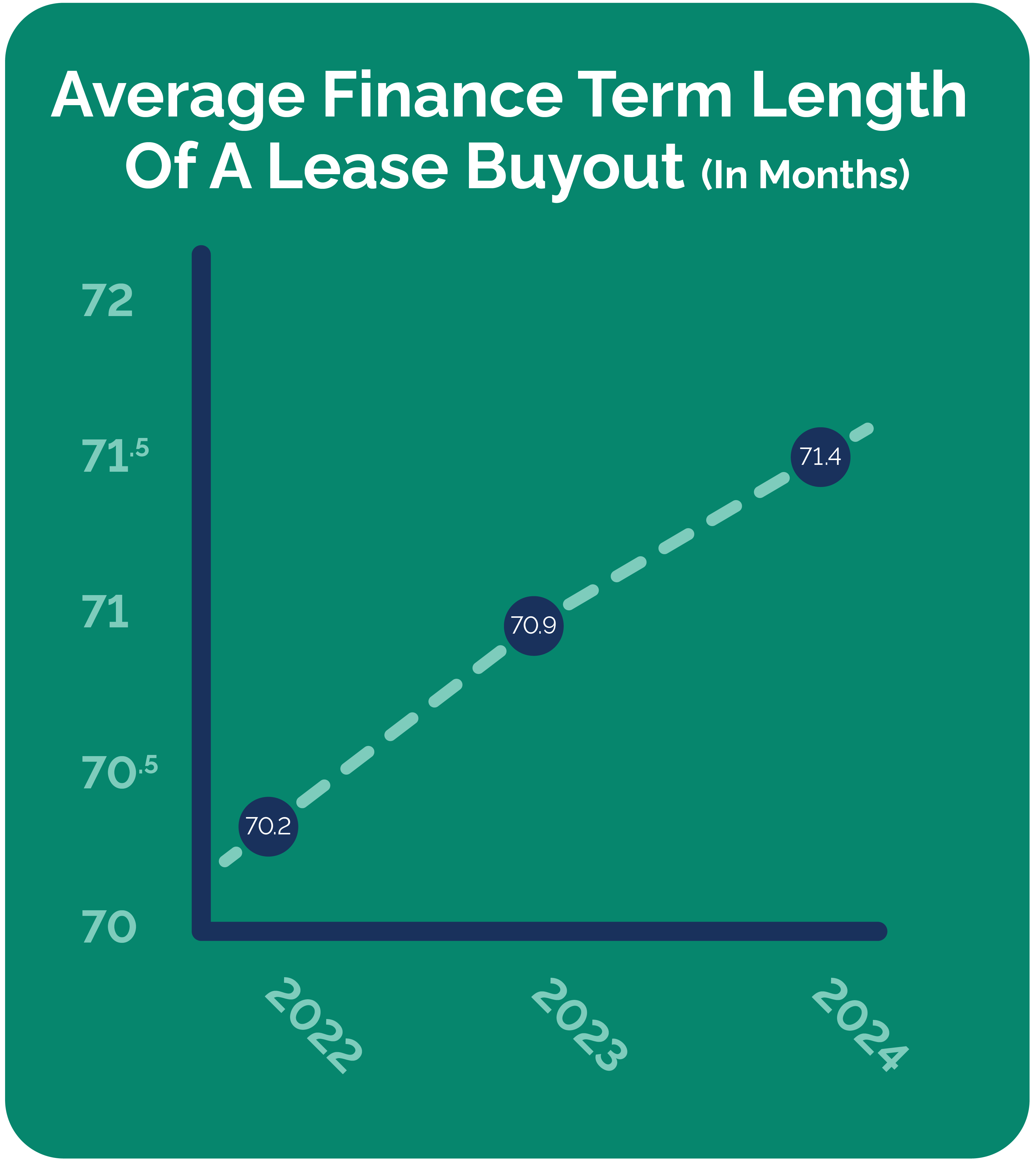

Americans are trying to reduce their monthly payments by spreading their lease buyout loan payments out further year after year, even after leasing already for 36 months.

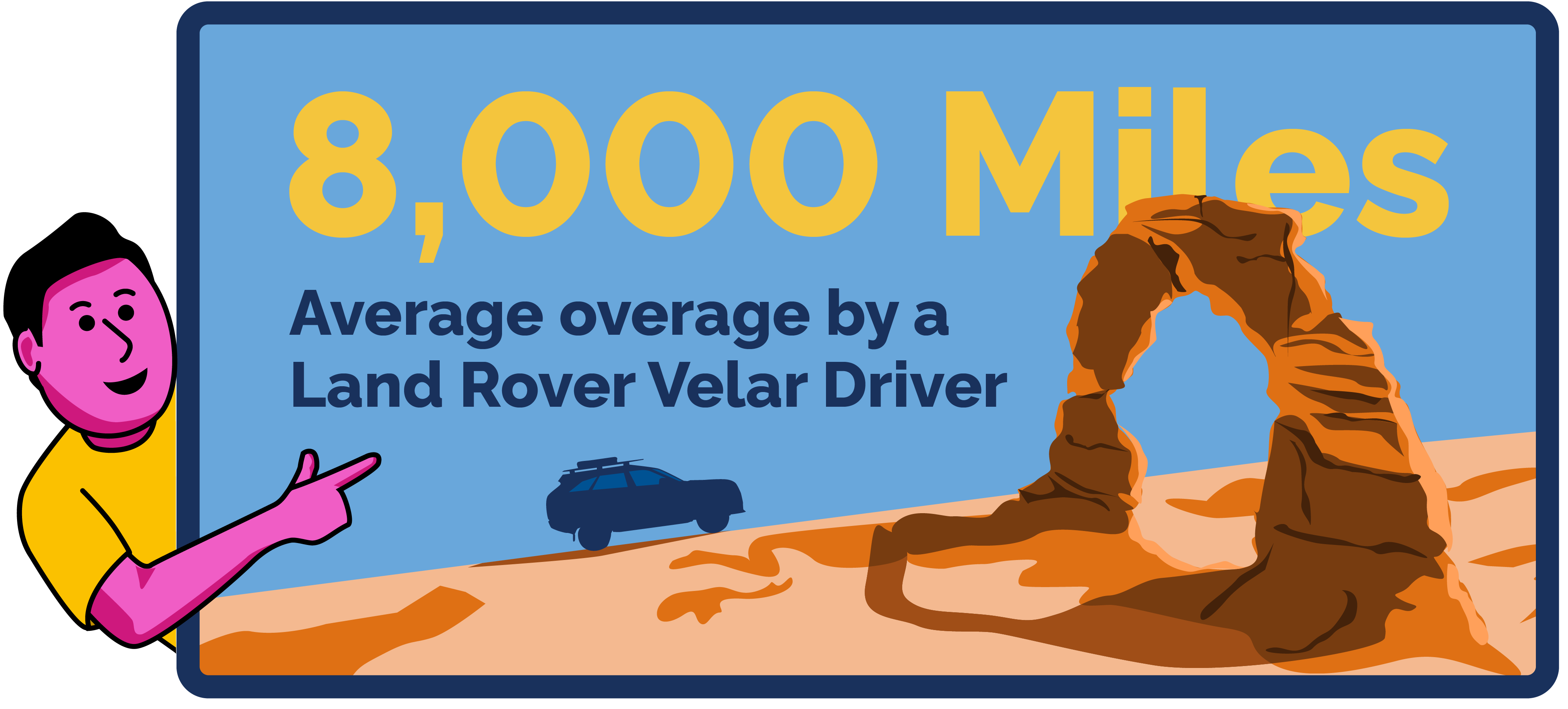

mileage overage fees

Mileage overages increased, on average (nearly 3,000 miles per driver), from 2023 to 2024, indicating overall driving increases that may reflect return-to-office mandates.

Often, drivers who go over the limit go way over. For example. lessees driving the Range Rover Velar exceeded the lease mileage allowance by more than 8,000 miles on average. If not for their lease buyout, they each would have paid their dealers $800-$2,400 in overage fees.

key industry trends

Equity Opportunity: Drivers are realizing that cars are often worth thousands more than their payoff price, leaving many with positive equity in their leased vehicles.

Buyout Popularity: With rising lease costs, more drivers are choosing lease buyout loans, which often means lower monthly payments than leasing a brand-new car.

Looking Ahead: Rising inflation and inventory shortages are expected to shape the 2025 lease buyout market and auto industry as a whole.